Can be in accordance with the pursuing the: CPF Normal Account, SIBOR, SOR or the Bank’s inner board speed

November 11, 2024 No Comments

When you’re to purchase a new domestic and promoting your existing one to, it could be challenging to get the time perfect. As an instance, perchance you found your dream family, nevertheless the sale in your newest domestic have not closed yet ,-and you’re wanting to know what you should do second. That’s where connection resource comes in. Find out how bridge money functions just in case it could be the best selection for you.

How do link resource functions? These short-name funds make use of your newest home’s security to cover several of the expenses of the new house, for instance the down-payment. Like that, you don’t need to overlook your ideal home if you find yourself wishing on your most recent family to close.

Bridge investment, also known as a bridge financing, are a way to assist link the newest pit anywhere between closure to your your existing household and your brand new lay since it gives you to carry the borrowed funds into the two features having a designated amount of your energy, generally a maximum of 3 months.

Precisely how does link financing works? These short-term fund use your newest residence’s equity to fund the the expense of the new house, such as the advance payment. In that way, it’s not necessary to overlook your ideal house if you’re prepared on the current home to close.

Like with most of the economic choice, there are advantages and disadvantages out-of bridge money funds. It is best to speak with a home loan Specialist regarding the book condition. For the time being, here are a few things should become aware of:

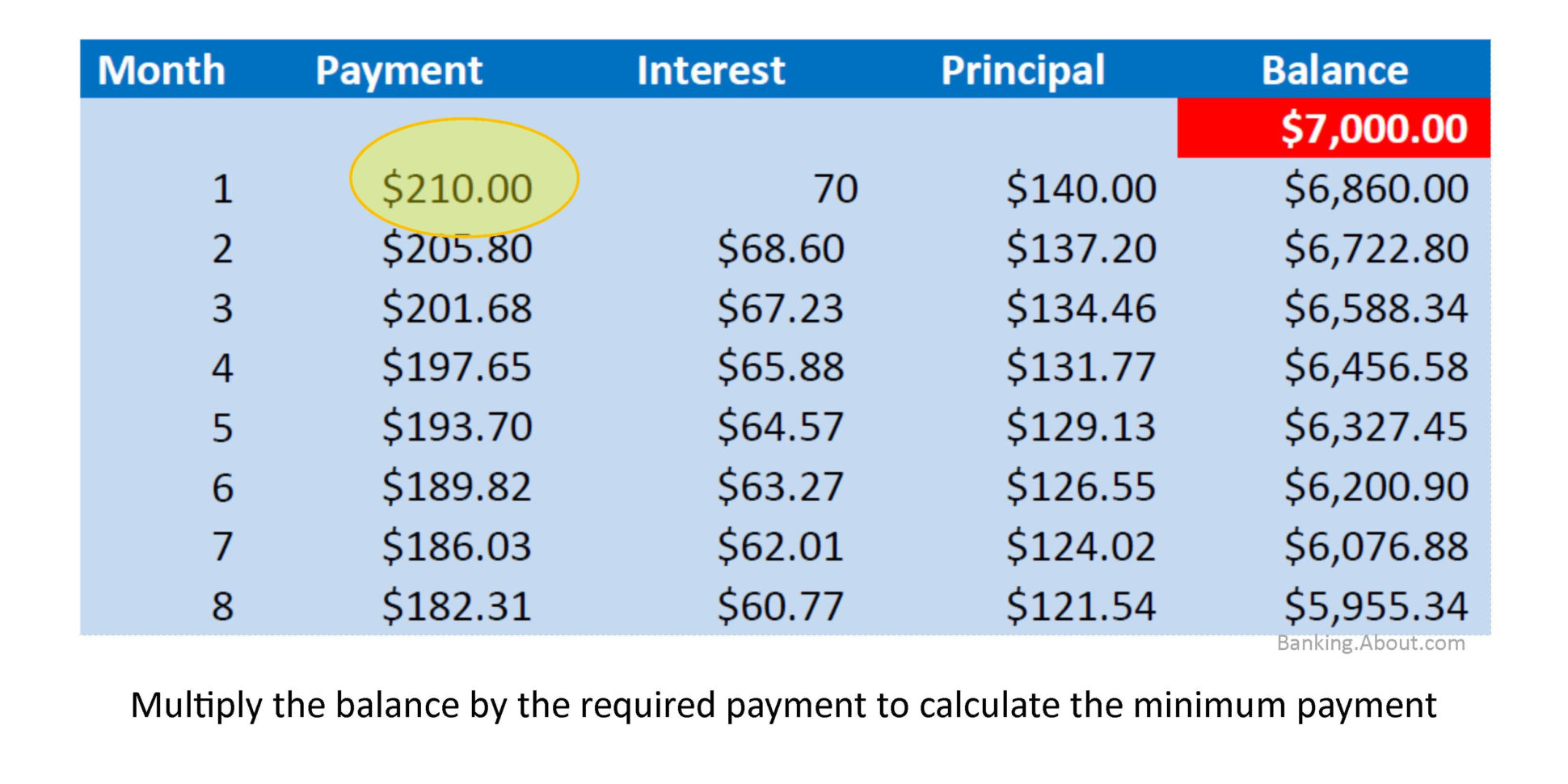

This is how: In case the newest residence is really worth $three hundred,000 and you are obligated to pay $two hundred,000 on your own home loan, you are eligible for a good $100,000 bridge mortgage. (Just remember that , the amount of the bridge financing often become reduced because of the a projected count to own settlement costs too.) As soon as your latest house deal, you to guarantee can be used to repay the connection loan.

Imagine if your closure big date for the new house is in thirty days, however expect to close in your established household inside the 90 weeks. A connection mortgage will take care of the fresh new two months around.

This is how: If the most recent residence is worth $300,000 while owe $2 hundred,000 on your financial, you are eligible for a beneficial $100,000 connection financing. (Keep in mind that the level of your own connection loan usually feel faster because of the an estimated number to possess settlement costs too.) As soon as your current household deal, that guarantee is used to settle your link mortgage.

A duplicate of your own Sale Agreement to the household you might be offering in addition to Pick Contract to the household you happen to be to buy.

You need to be approved to own a great TD Canada Believe Home loan otherwise TD House Security FlexLine for the the new property so you can be eligible for a connection mortgage.

Can you imagine you need more substantial mortgage otherwise a link financing beyond 3 months? Our very own Home loan Specialist will help describe your options.

You have found just the right set and want to operate. State you have located yet another place before your current family selling shuts. It’s not necessary to allow your dream family sneak aside. Which have connection funding, you can be motivated and americash loans Redstone then make an offer as you prepare.

You can’t manage an advance payment with no money from the latest home. When you find yourself offering property, timing cannot always work out well. If you prefer a little extra bucks making a down payment in your new home, connection financial support might help safeguards the difference up until the business closes on your own latest put.

You prefer time passed between closing times. Maybe you must transfer to your new house before your own most recent domestic closes, by way of example, to complete certain home improvements. If so, bridge investment are a substitute for think.

Tags -

November 11, 2024 No Comments

October 10, 2024 No Comments