Yet not folks are flush into bucks they have to simply take its providers to a higher level!

November 11, 2024 No Comments

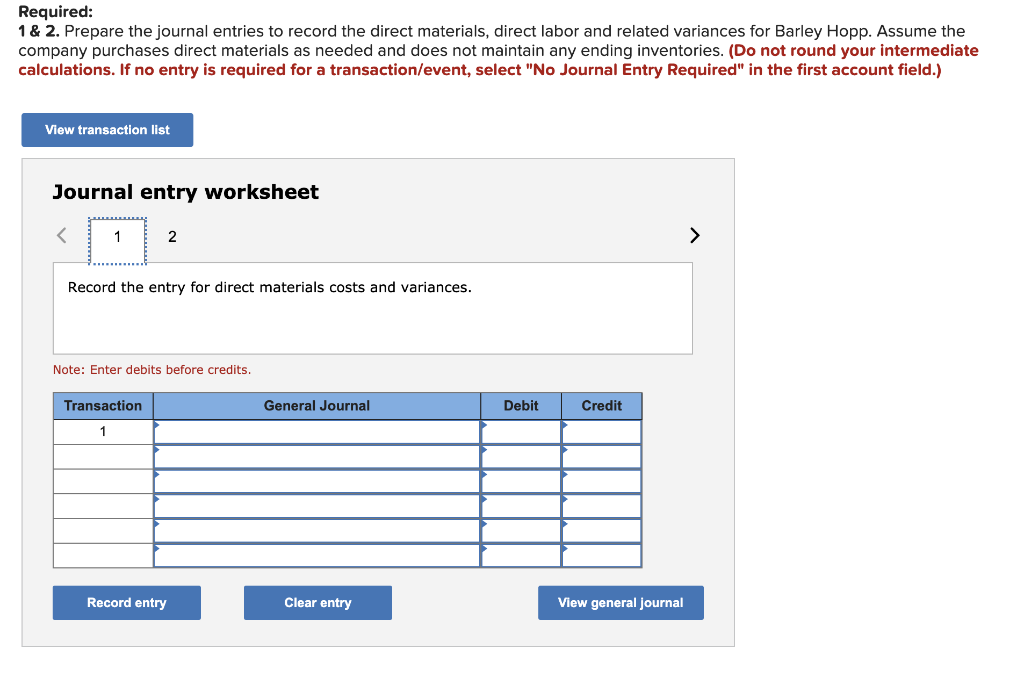

You can find novel industrial financing one to business owners usually takes benefit of. Regardless if you are thinking of buying work place otherwise you desire money to have one to next stage on your own business plan, listed here are your main choice.

As name means, a professional home loan is used to order commercial possessions. You are able to these types of commercial mortgages to acquire real estate just like the company room or to pick characteristics as a financial investment.

In umbrella off commercial real estate fund, you can find even more sandwich-products, in addition to long lasting funds, which play the role of a primary financial to your a commercial assets. Anyone else, eg blanket finance, are designed to defense the purchase out-of several services. Regional industrial loan providers could work to you to come up with a loan that suits your unique business needs.

A corporate personal line of credit is a type of industrial mortgage you to definitely shares of several qualities regarding credit cards. In place of getting the funds in one single upfront lump sum, you are able to be eligible for a maximum count. You may then draw money from their credit line while the you want them. The good thing about any of it is you pay attract simply about what you use- not towards restrict number.

This will make a personal line of credit great for businesses exactly who will get sometimes you desire finance to pay for performing expenditures or perhaps to buy devices as you wade.

Your line of business ent to manufacture your merchandise or carry out their services. Products go along with a substantial cost which you are unable to protection that have cash on hands.

Unlike purchasing your products downright, you might financing they using a loan. This means that you can pay it off throughout the years- that have appeal payments included, without a doubt. A couple of times, the machine in itself usually act as equity on mortgage, that makes this type of mortgage better to qualify for than just other people. not, for individuals who default, the bank can be grab the equipment.

A corporate term financing are a flexible mortgage which have a regular payment agenda. Particular general features of this kind regarding mortgage are:

As you may make use of the currency however you select easily fit into your company, a phrase financing is excellent for those who have some other aspects of expenditures to fund.

A commercial build loan is similar to a bona-fide house financial. The real difference would be the fact a housing financing was created to shelter creating and strengthening a pattern that does not are present yet. Thus whether you have got a vision to have a proprietor-filled a workplace, a business center, otherwise an imposing multi-friends real estate investment, a professional construction loan are definitely the tool to really make it takes place off scrape.

Specific enterprises you need vehicles getting providers-associated surgery. These can be obtained that have a commercial car finance, that is https://paydayloanalabama.com/maplesville/ like a buyers car loan. Once the automobile depreciate so quickly, of many creditors simply promote financial support toward latest vehicle, which is important to consider when building your collection.

Also keep in mind that the kind of loan is the greatest to possess mediocre auto such as for instance trucks, vehicles, otherwise get a hold of-upwards autos. If you want financing to have a more impressive automobile, eg a partial-truck, equipment funding is the more sensible choice.

The latest You.S. Small company Management (SBA) has several mortgage apps one to small enterprises can apply having. Each SBA program comes with its very own number of meant spends and eligibility conditions.

SBA fund commonly indeed financed of the SBA themselves. It make sure the mortgage; money are offered through-other activities. Including, you might sign up for good eight(a) loan throughout your regional financial who gets involved from the system, and the SBA manage back the mortgage. An official development providers would provide an effective SBA-supported 504 mortgage, and you can SBA microloans are funded compliment of intermediary loan providers that partner which have the brand new SBA.

Bridge loans are made to complete this new gap between just what a good providers demands at the moment and you will a lengthier-label funding services. This type of faster-label money features large interest rates than simply permanent finance, however, allow it to be organizations to meet up instant loans by providing a short-term cash flow.

Both, companies need to purchase things upfront that wont end up being marketed up until after. Instance, when you have a shirt range, you can also buy information initial in bulk, although the designs would not smack the cabinets all at once. Collection money is designed to assist security this type of costs. The loan is actually backed by the directory as the equity.

Charge money would be a dangerous undertaking for creditors, this is exactly why these are usually approved on an instance-by-circumstances base.

This only scratches the top of resource options available so you’re able to smaller businesses. Prior to a choice, definitely very carefully look into the information on that loan type of. Insurance firms a beneficial understanding of exacltly what the providers demands and you can working with a reliable, community-depending financial, you can get the amount of money to help keep your business flourishing.

Tags -

November 11, 2024 No Comments