Techniques for Best Paperwork and you can List Keeping

December 12, 2024 No Comments

An eco-friendly case color could make you then become unwell, but you’ll still you want so much more facts to the Irs to help you will let you discount your property developments to have scientific objectives. Particular, needed medical renovations try tax deductible, though. Renovations otherwise special gadgets clearly needed for medical care people, your spouse, or the created all are deductible out of your modified gross income.

Ways these scientific home improvements try eligible to taxation deduction motives is a little murkier, even though. The newest nuance is inspired by perhaps the renovations that you might want to own health care increase the worth of your property or not.

In the event the developments improve the property value your home, he is thought investment improvements and therefore are tax-deductible. Whether your home improvements do not improve the worth of the family, chances are they aren’t tax deductible.

Residents and renters equivalent are eligible for home business office income tax deductions for just powering all of the or a fraction of their team out-of their home, for as long as the company is the principal place of its business and the working area of its residence is used exclusively to possess team.

Someone spending hours per week in their house office would be considering updating its space. The brand new Internal revenue service allows for office at home developments to get tax deductible if they meet a few criteria. The home improvements or repairs should be made solely into work place to subtract the complete matter. An example from an income tax-deductible do it yourself is repairing a reduced screen.

Repairs or renovations you to definitely work with your family and you may family place of work can be subtracted given that a portion of one’s total cost considering just what percentage of your home is utilized for an excellent home business office.

Including, repainting your entire house getting $1,000 does not always mean you may also dismiss the complete $step 1,000. For folks who only use 10% in your home only for your organization, then you can merely dismiss $100 of repainting rates.

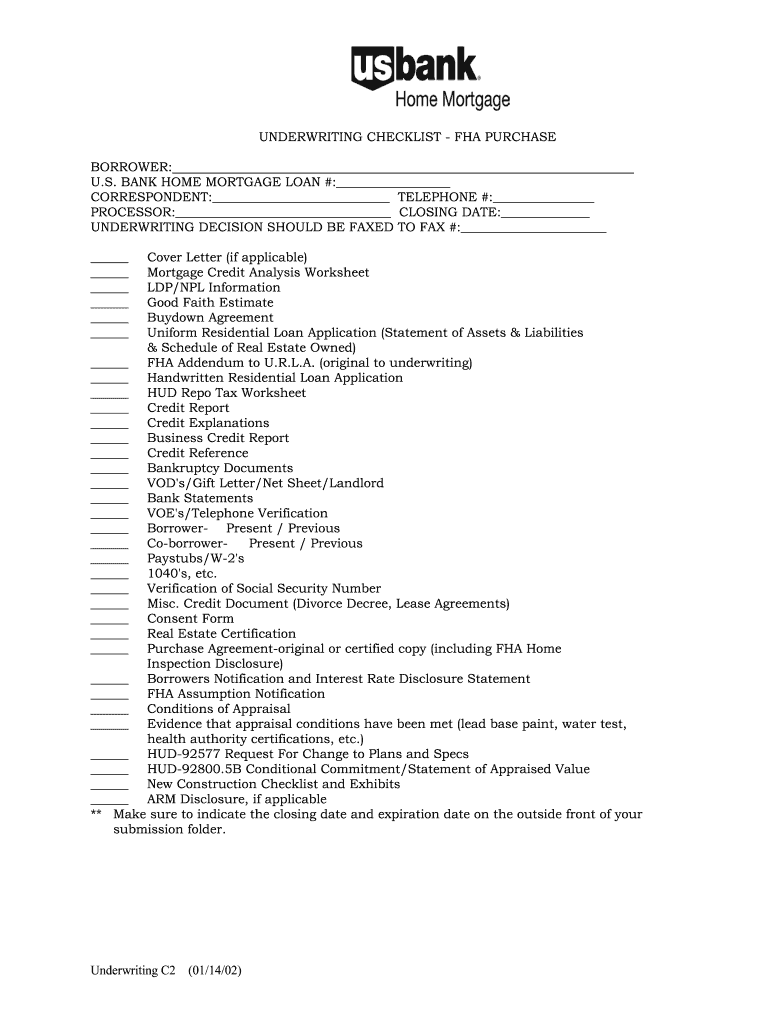

Paperwork is a must so you can guaranteeing your bring receipts for your tax deductions. This new Irs brings a worksheet to help property owners track expenses one they feel was tax-deductible.

Whether residents decide on the fresh IRS’s worksheet otherwise remain the facts differently, they should continue one receipts, canceled inspections, currency purchases, contracts, and other records regarding our home developments for a few decades from the go out from processing otherwise a couple of years on day of one’s fees repaid.

Given home improvements so you’re able to personalize your house otherwise boost property value? Below are a few the publication-Running It: Investing Your home-to learn more about simple tips to bundle and you may buy the investment.

Tax loans and write-offs both mean taxpayers will owe smaller. The real difference is during the way they reduce you to definitely amount. Tax loans reduce your balance dollars getting dollars, while you are income tax write-offs lower your modified revenues, meaning you pay taxation with the a lesser amount of.

A similar Internal revenue service stipulations incorporate if the home you will be making improvements so you’re able to is your first quarters otherwise accommodations possessions. Renovations you to definitely meet the requirements to possess funding upgrade, necessary medical changes, online payday loans Iowa otherwise times-efficient upgrades meet the requirements having income tax professionals.

Residents should keep people receipts, canceled inspections, currency instructions, contracts, and other records linked to the house developments for three decades regarding the go out of filing or couple of years on big date of your fees paid off.

Tags -

December 12, 2024 No Comments

October 10, 2024 No Comments