LTCG and you can STCG Prices inside the 2023-24 and you will 2024-twenty-five – Research

December 12, 2024 No Comments

The latest possessions the assessee retains for more than 36 months are called enough time-identity financing property. The gains of attempting to sell such property are known as long-name resource gains.

If unlisted shares, homes, or other immovable possessions take place for over two years, its thought a lengthy-title funding investment.

Having Point 54 of one’s Tax Act, our home possessions is held for over 2 years to adopt a secured asset just like the an extended-title resource resource.

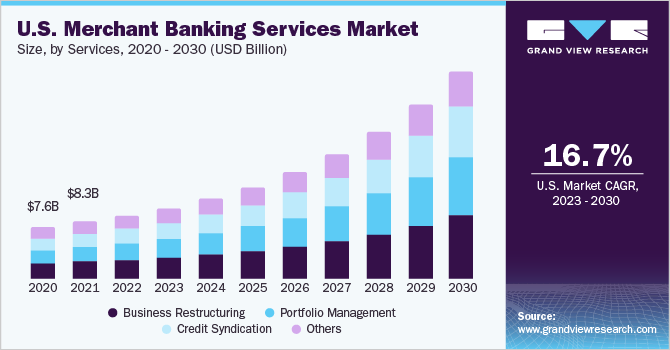

Funds 2024, launched toward 23rd , brought about specific changes in the brand new much time-label and you will small-label resource growth tax prices and carrying symptoms. Here is a desk demonstrating this new review between your financing gains tax costs from inside the FY 23-24 and FY 24-twenty-five.

Based on that it section, when a keen assessee sells home, a lengthy-title money asset, and you can buys a new domestic domestic possessions, he or she can allege a taxation exception. Down the page certainly are the criteria of qualifications having point 54 difference.

If your private doesn’t match the above conditions, he is not liable so you can claim an exception less than Point 54 of Tax Operate. Simply instance purchases because of the taxpayer are eligible for the different around Part 54 of Taxation Work.

Point 54 of the Taxation Act allows the low off the 2 since the a different number to possess a good taxpayer:

That have feeling out of Analysis Seasons 2024-twenty-five, the fresh Fund Act 2023 enjoys minimal the most exemption getting greeting under Section 54. Should your cost of the fresh new asset is higher than Rs. 10 crore, the other amount is neglected for calculating the difference around Section 54.

Such as for example, Mr. Anand sells their family property and you can produces an investment get out of Rs. thirty-five,00,000. On the revenue amount, he bought another type of family to possess Rs 20,00,000. The fresh new exception around Point 54 could be the lower level of Rs 20,00,000.

The capital increases which might be responsible for tax may be the harmony away from both, that’s Rs 15,00,000 ( thirty five,00,000-20,00,000).

In the event your new home is available inside installment loan Riverside a time period of step 3 decades regarding day out of buy/construction, then the exception claimed might be reversed and get nonexempt from inside the the year from sale. In this case, consider dos some other problems -

Circumstances step 1. The price of new home purchased is below the capital development calculated with the product sales regarding possessions

In the event that the newest home is sold within this 36 months of the go out from pick, the expense of buy becomes nil plus the harmony amount will get taxable.

Tags -

December 12, 2024 No Comments

November 11, 2024 No Comments