When you should Rating a home loan to suit your Travel Assets

December 12, 2024 No Comments

A holiday household enables you to delight in leisure time in an effective breathtaking environment and you will allows you to safe an additional resource for your portfolio too. A second household enables you to see breathtaking leases that you totally manage. As to the reasons enrich hotel and resorts citizens when you might be strengthening security with your own personal cottage or travel assets?

A secondary real estate loan may come with higher rates of interest and you may more strict criteria. Although not, you will find some reason why you may get a vacation possessions:

Applying for the next financial is sold with some more strict official certification than just a primary mortgage, however, you’ll find alternatives. That have a secondary household, ready yourself to possess extra money supplies. Just be sure to possess a more impressive deposit to own a next domestic, generally speaking between ten% and you may 20%, whilst the amount you need are very different, according to your position.

In some cases, you may be able to utilize brand new security from the newest home to purchase the down-payment for the a vacation assets. You will not always manage to qualify for a government-insured loan with this type of pick.

Which have a vacation possessions home loan, try to enjoys a couple of to 6 months of money reserves, equal to the amount it can sample shell out both your own mortgage and travel possessions mortgage of these days.

You’ll also you would like good credit and you will a powerful obligations-to-money proportion. Criteria to own credit scores are quite higher than he or she is for primary home loans.

When buying a holiday household, you might think you could potentially book your home part-big date that have an initial-identity leasing system and employ the latest continues to invest the borrowed funds. To achieve this, you must know the principles.

Federal national mortgage association, a company hence produces the fresh laws and regulations on home loan community, do ensure it is home owners so you’re able to book the travel home part of the time and you may qualify for a holiday home mortgage. Although not, you will find some caveats.

If you lease your trip household more than periodically it could be considered an investment property. If it is a residential property, attempt to qualify for a good investment financial, which comes which have more strict requirements and higher costs. Additionally, you can not make use of the expected local rental income in order to qualify for the financial.

When you need to earn some money on your trip domestic but don’t want an investment mortgage, your residence must qualify as the next house. To do this, it ought to fall in completely to you personally, feel a single-device home and stay designed for seasons-bullet explore. As well, it must never be controlled by a management company, must not be good timeshare and may not be rented complete time. The vacation family should be a reasonable range from your household.

Trips mortgage costs is more than the attention with the first home but below investment property prices. The specific costs you are billed depends upon a number of circumstances, like the down payment you might bring, your credit rating, debt standing and more.

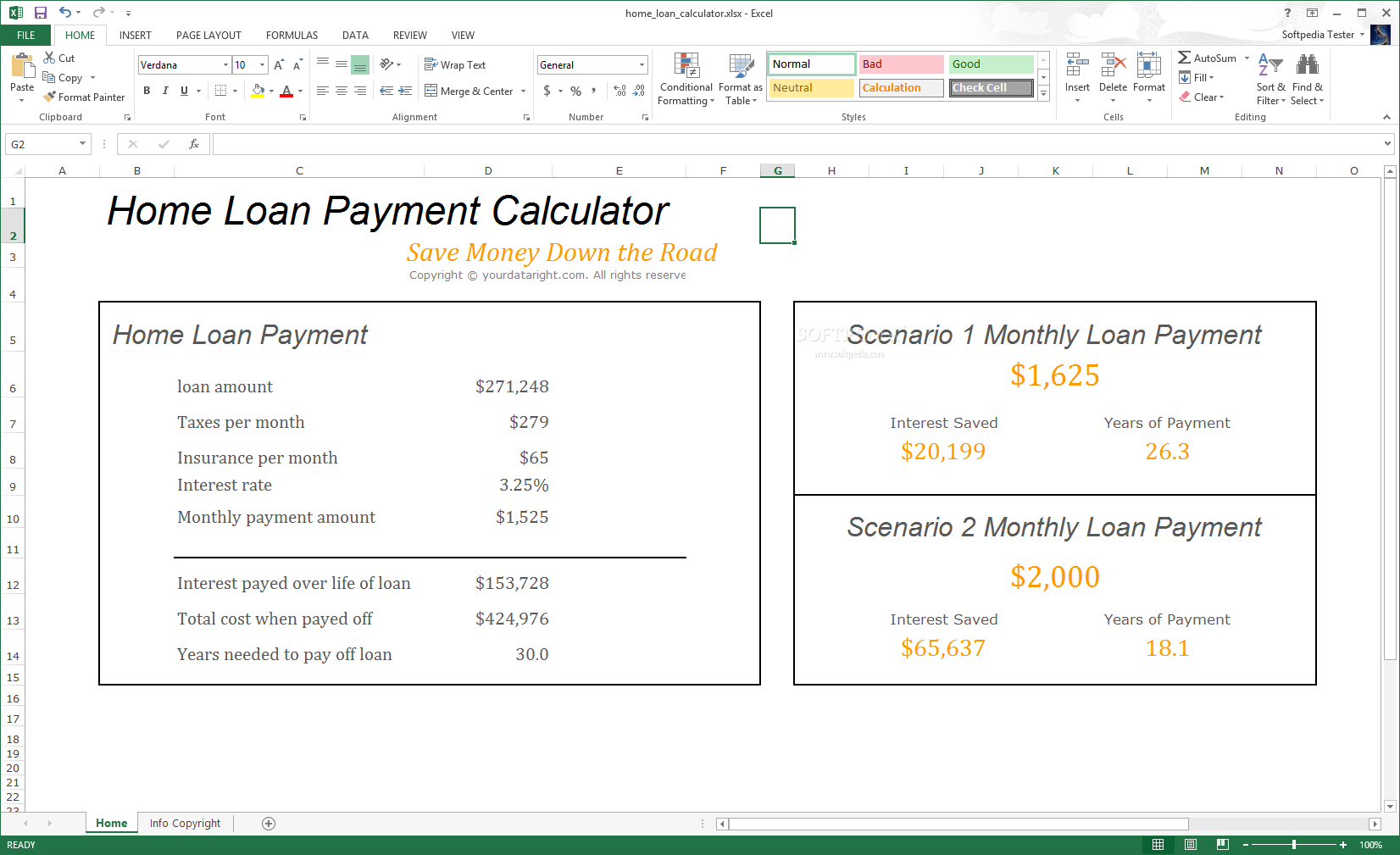

If you want to know the way far you may pay, play with a secondary real estate loan calculator otherwise get in touch with a neighbor hood Warranty Financial loan administrator. You can walk through brand new pre-certification procedure with these virtual assistant, Abby.

If you want to get a cottage or any other travel property, you’ll basic would like to get on the most readily useful budget it is possible to. Lower expenses, improve your credit rating and save currency both for your own bucks reserves and you will downpayment.

While doing so, look at the right financial support for your 2nd possessions. It is possible to refinance a current property, bringing the difference in dollars and making use of the bucks to shop for otherwise place the downpayment towards a moment household. If you are able to afford the higher costs monthly on your financial, you can enjoy a good rates of interest with the a cash-aside home mortgage refinance loan.

You can also find property guarantee personal line of credit (HELOC) on your top house and make use of new guarantee from your own home to find one minute household. Your HELOC will not effect your home loan and you will certification for it variety of mortgage is frequently short. It’s also possible to be able to take pleasure in low interest rates, even though you will need to thought you will have to shell out a couple debt costs if you take that it route.

You’ll be able to only rating a traditional mortgage to your vacation assets. This really is good alternative without having far collateral on your newest household otherwise do not want to faucet your own family and other tips to find. Whenever you put down a good downpayment regarding on minimum ten%, you may also meet the requirements.

Before taking the fresh dive and purchase, your ine exactly how another house make a difference your finances and you may their fees. When it is a genuine travel home, you will be capable understand particular taxation holiday breaks. not, you’ll also have to pay assets taxation, repairs, insurance coverage and other expenses. Do the mathematics.

Before you buy, you are able to desire to keep in touch with a Promise Financial loan manager to know your options in order to score approaches to the issues. That loan manager can supply you with a rate quote and certainly will make it easier to see most recent home loan rates vacation home also funding choice.

Trying to get a holiday real estate loan should be effortless if you’re speaking about people someone instead of numbers. At Guarantee Financial, i pride ourselves on coping with borrowers and customers to assist all of cash day fast loan loan loan pay payday quick them find the correct mortgage loans and you may prices because of their lifestyle. We’re clear, honest and you may response and we also provide totally free, fast prices.

We walk you through the easy procedure, you start with pre-certification, that simply take simply 10 minutes. You can aquire a speed price and you will a feeling of how much you really can afford. Once you come across a house you love, complete a full software. I care for underwriting for the-family and when you have got experienced handling, and appraisal and you can acceptance, you can talk with a notary in order to sign the latest files and you will personal the borrowed funds.

Tags -

December 12, 2024 No Comments

December 12, 2024 No Comments