Hold back until Your Be eligible for PMI Cancellation

December 12, 2024 No Comments

In case the antique mortgage includes PMI, you’ll need to generate people insurance coverage repayments up to you have built from the minimum 20% guarantee in your home (predicated on the house’s fresh really worth). All compliant conventional loan enables you to remove PMI will eventually. Below are a few ways to was.

The home owners Safeguards Work out-of 1998 need the loan servicer in order to instantly drop PMI in the event your mortgage balance are at 78% of your home’s purchase price. When you purchased a home to possess $200,000, then you’ll reach this aspect after you pay down the bill to help you $156,000 ($2 hundred,000 x 0.78 = $156,000).

Rather, your own servicer need certainly to cancel PMI once you reach the midpoint from inside the the loan identity, in the event your dominant harmony has never yet , reached 78%. Into a 30-season mortgage, for instance, you get to this aspect just after cash advance loans Macclenny fifteen years.

In the two cases, you must be newest on the financing costs as well as in a great standing on the bank. Meaning you haven’t overlooked otherwise produced shortage of money while in the people few days. That one ‘s the safest as you don’t have to complete a consult or place additional money with the the borrowed funds. However when your loan reaches the newest 78% threshold, you should check the loan comments to make sure the lending company eliminated PMI.

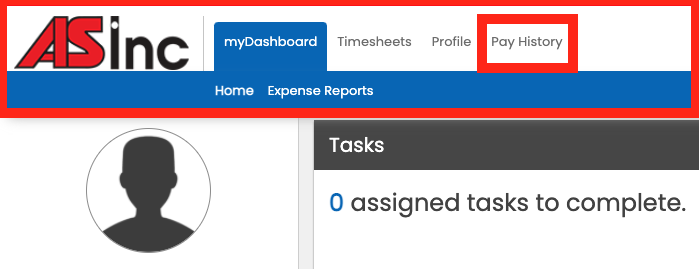

You don’t have to wait until the loan equilibrium has reached 78% LTV. As an alternative, you could ask your servicer in order to cancel PMI as soon as your loan harmony drops to help you 80% of the amazing value of the house or property. Towards an effective $two hundred,000 property, would certainly be able to terminate PMI when your mortgage harmony strikes $160,000 ($2 hundred,000 x 0.80 = $160,000).

It could take you on 7 years and nine weeks in order to arrived at that it restriction if you have a cuatro% interest rate and a 5% advance payment. Requesting cancellation at this point could save you a while of cash versus waiting until you has actually an excellent 78% LTV, otherwise $156,000 towards mortgage.

The fresh date you are able to the latest consult shall be incorporated towards the your PMI revelation mode. Their lender is always to provide the revelation at the closing with your other financial documents.

Another option are getting more cash to the the loan prominent if the you have the more income to spare. It will help your build 20% collateral on assets quicker, versus settling your own financial with regards to the totally new commission plan.

In addition, you spend less because focus try used on a smaller sized harmony each month. First consider simply how much more you can spend, such $50 30 days otherwise an additional $step one,000 annually when you get an effective windfall. Following have fun with an internet financial calculator to crisis the quantity.

Tags -

December 12, 2024 No Comments

December 12, 2024 No Comments